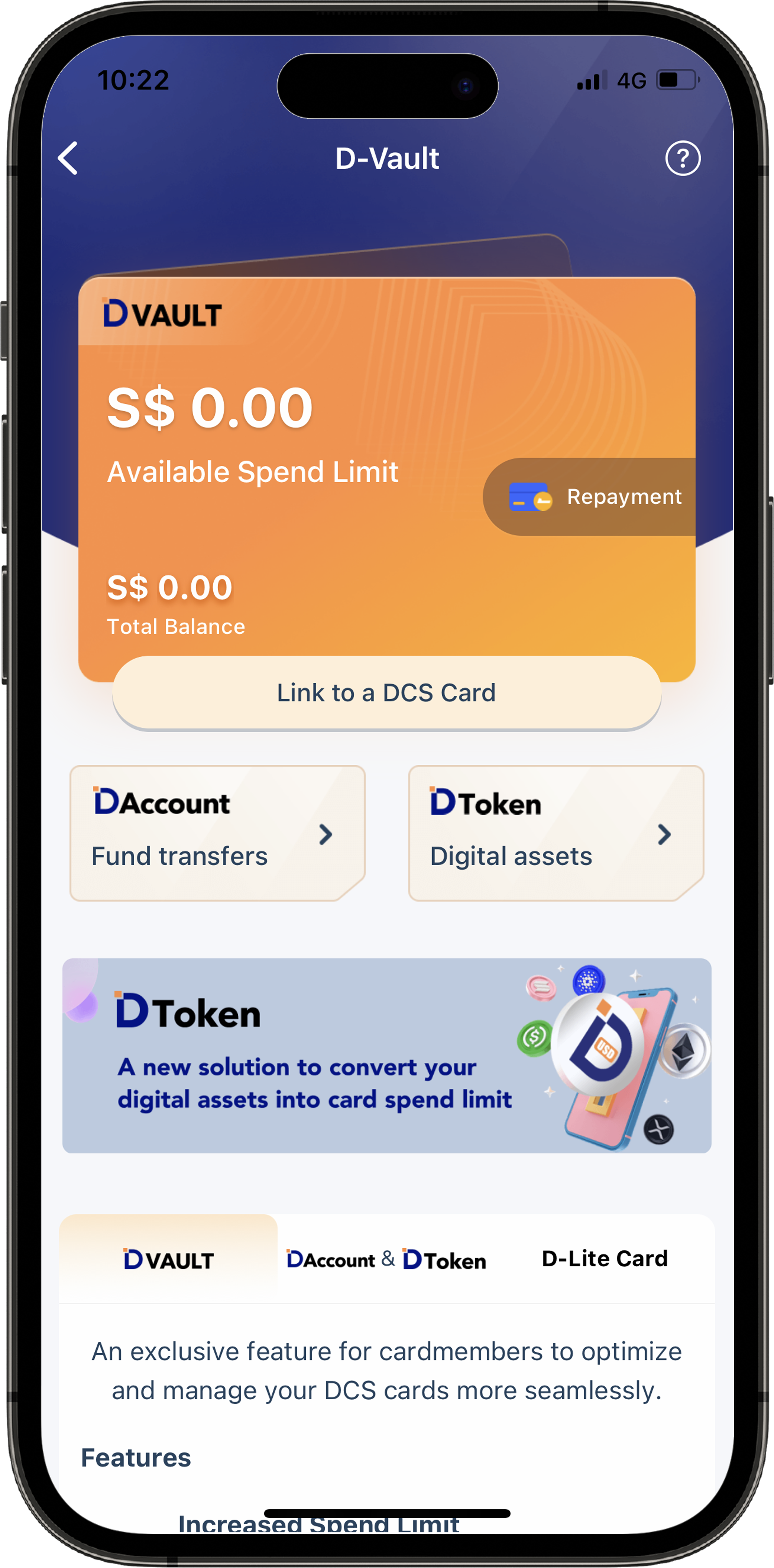

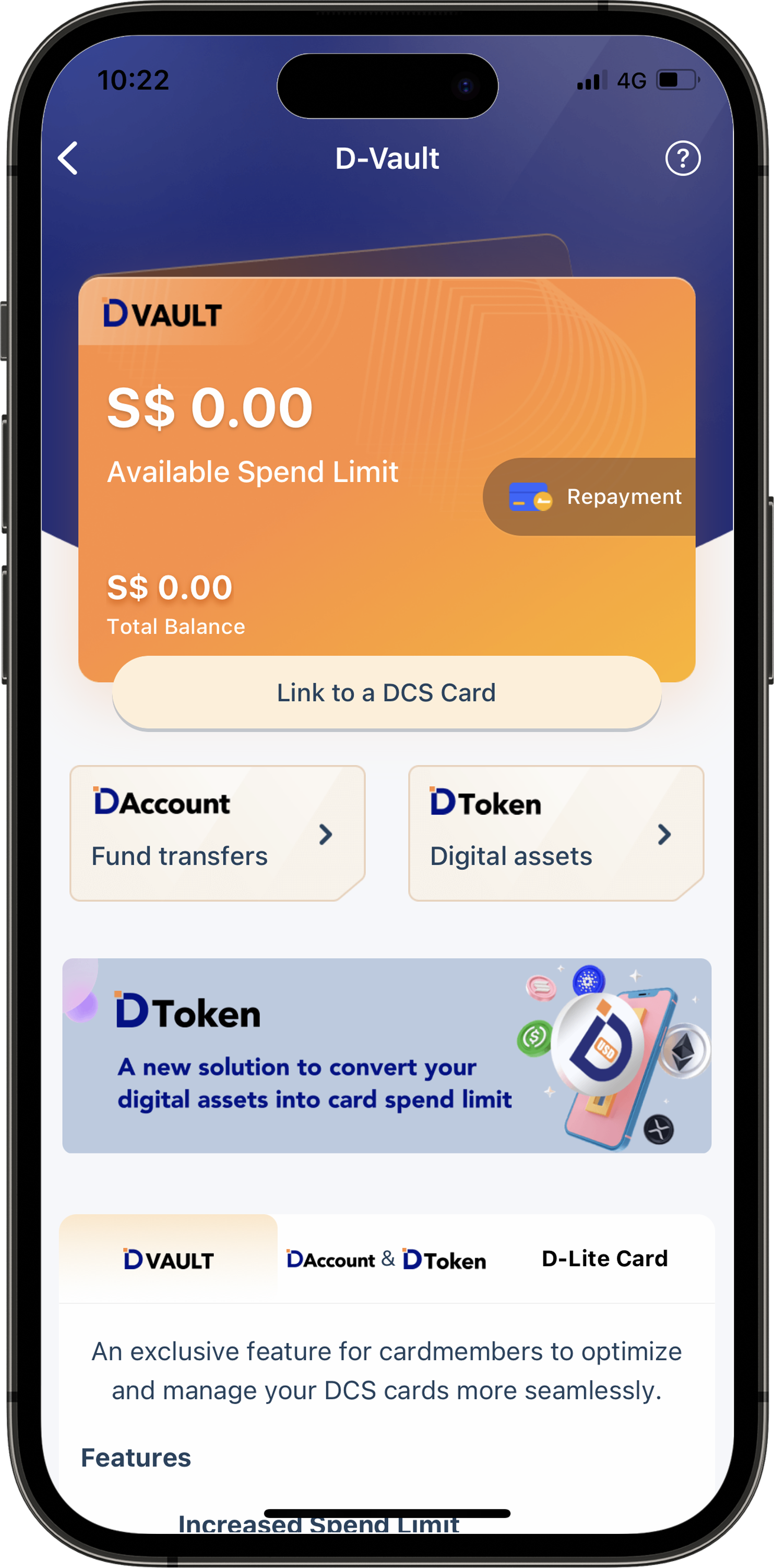

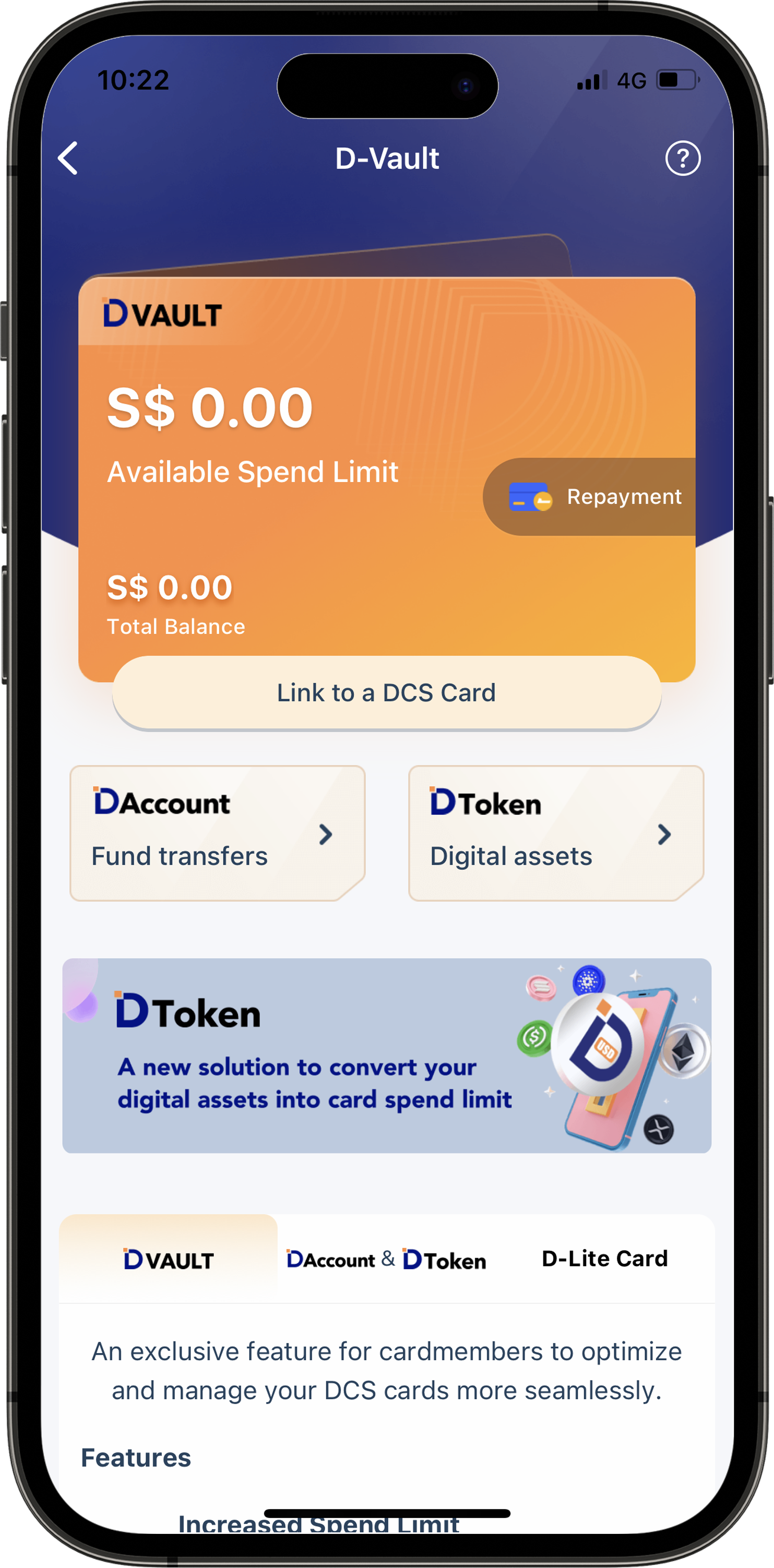

An exclusive account feature offered to Cardholders to aggregate assets into a central balance that may be utilized to pay down balance(s) incurred on any DCS Card(s) or linked to a preferred DCS Card as spend limit.

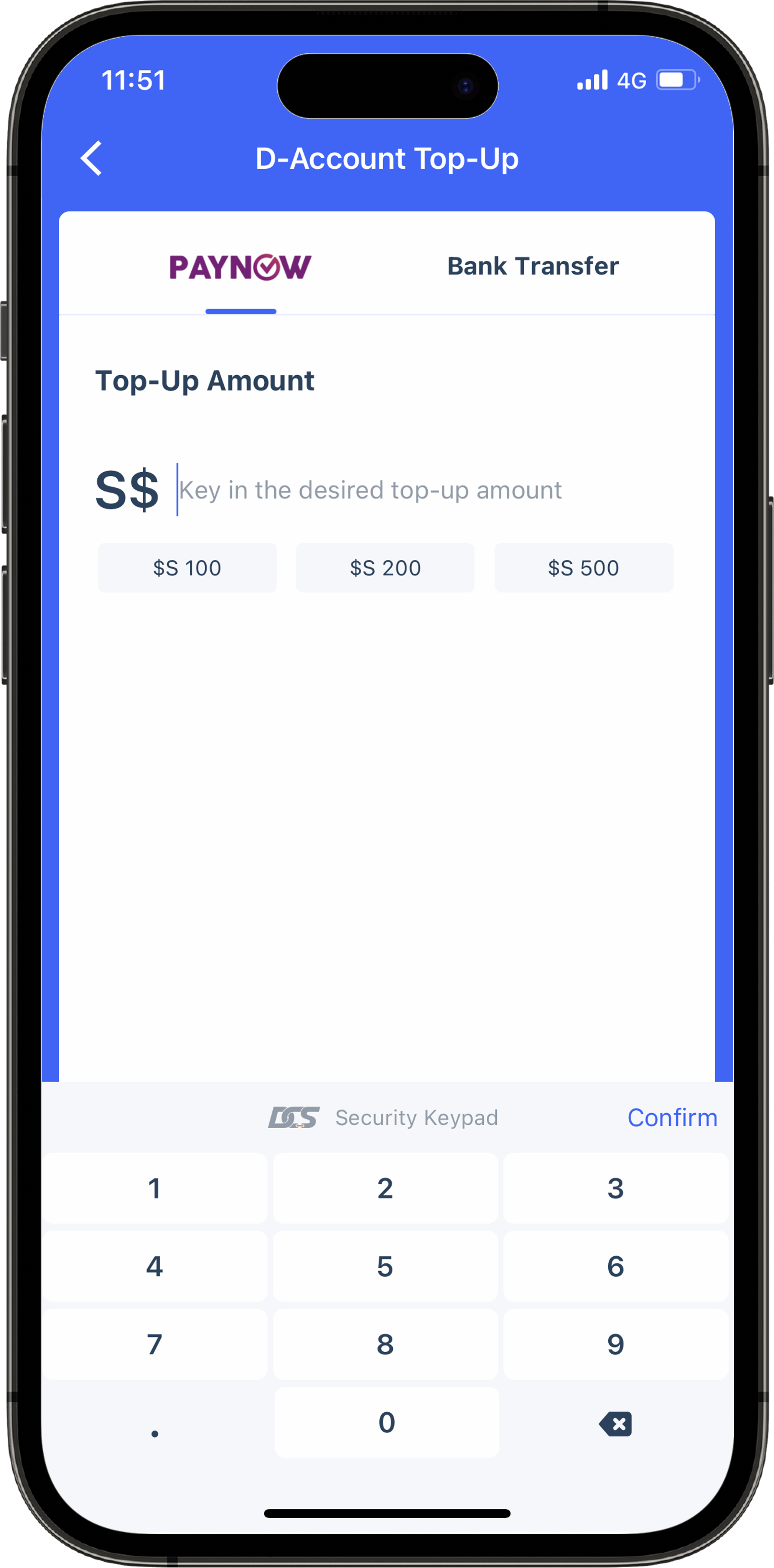

D-Account is a top-up channel via bank transfers for D-Vault. Receive a unique account number and use it to directly receive funds from any bank account.

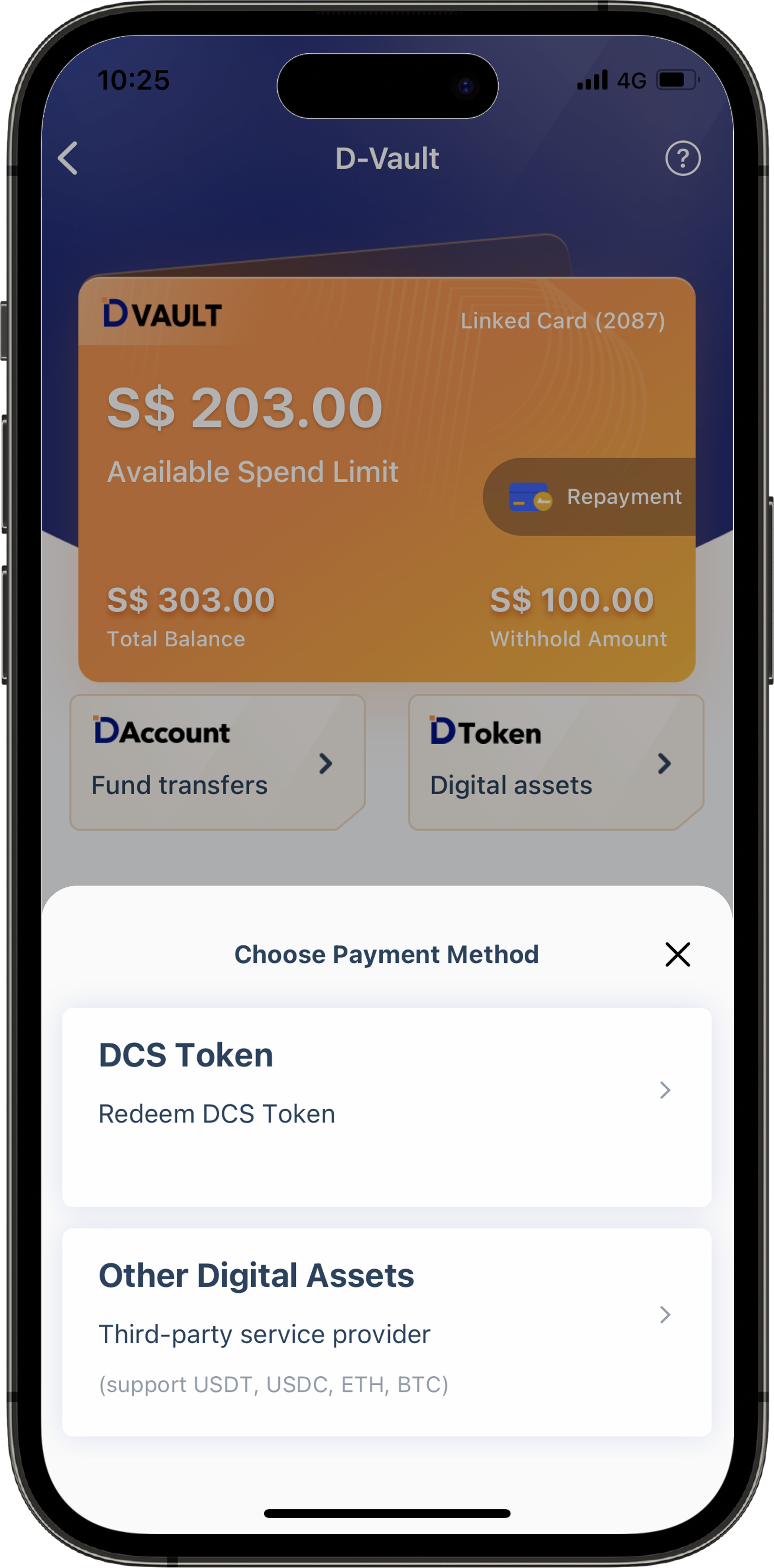

D-Token is a top-up channel via digital assets for D-Vault. Choose to top-up with DCS Tokens or other digital assets seamlessly.

D-Vault Features

Here's a scenario where you'll find D-Vault useful

A luxury item has caught your eye while you're out shopping, but your available credit limit is insufficient to pay for it.

To make your purchase, you currently have two options. You could call the DCS customer service team to request for a limit increase, but the process will take time and the new limit may be insufficient. Alternatively, you could pay with cash but this means foregoing your credit card benefits, such as Cashback.

This is when D-Vault becomes a convenient option. Simply login to the DCS Cards App to top-up your D-Vault and the spend limit on your DCS card will be increased instantly!

FAQs

Brief and Introduction

D-Vault currently supports top-ups via bank transfers and conversion of digital assets. The processing time for each type of top-up differs according to the providers that process the transfers.

For D-Account transfers initiated from a participating bank of the FAST network in Singapore, the funds should typically arrive within 15 minutes barring any unforeseen system disruptions. Fund transfers made via other platforms will be subject to respective processing times that are not within DCS’s control.

D-Token transfers are only processed by partners appointed by DCS. Top-ups using DCS Tokens (DUS) are processed instantly and equivalent funds in SGD will be credited into D-Vault within 15 minutes subject to successful compliance checks and barring any unforeseen system disruptions. Whereas top-ups with other digital assets will be subject to a longer processing time of maximum 3 working days.

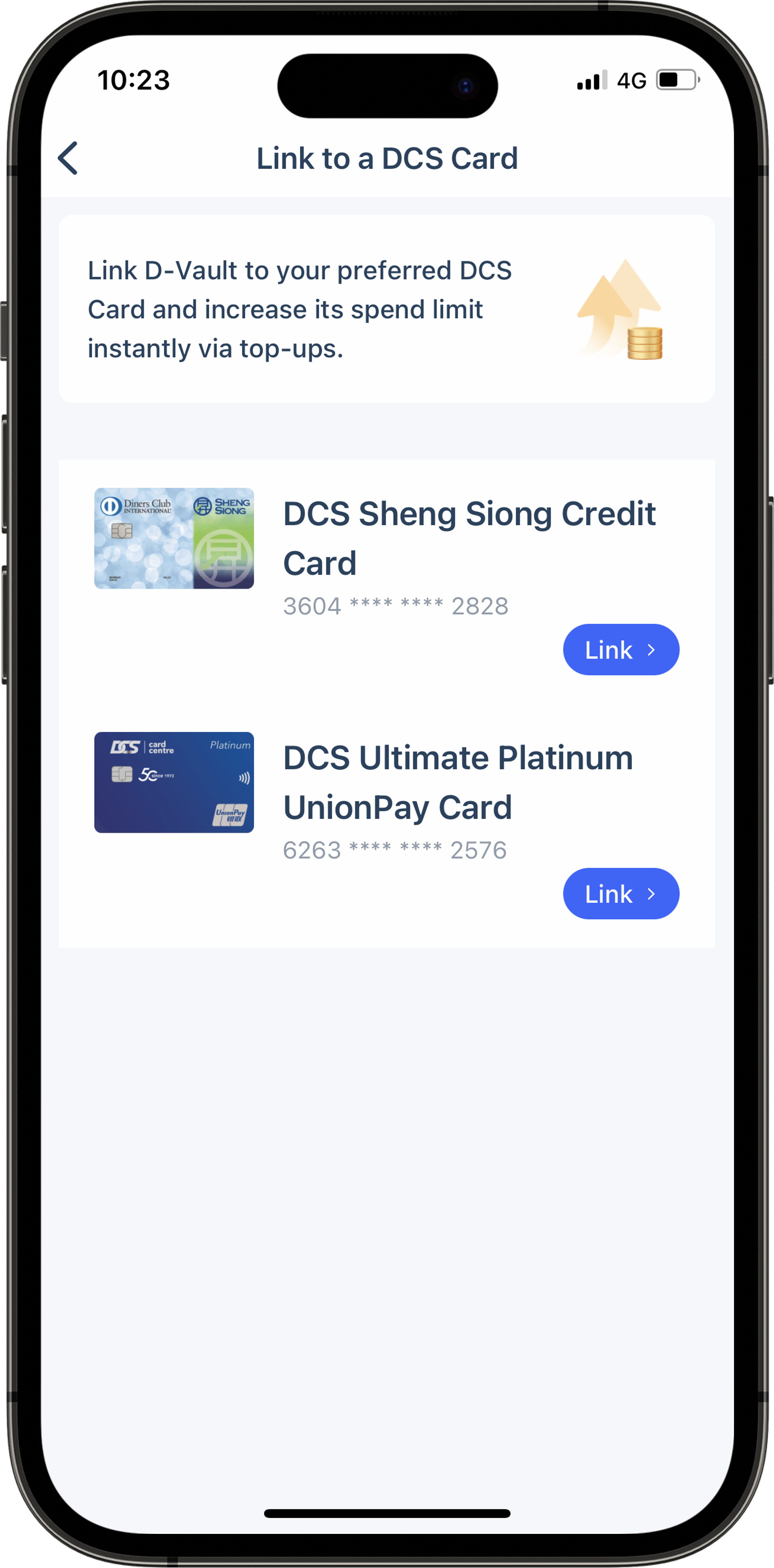

Link-to-Card

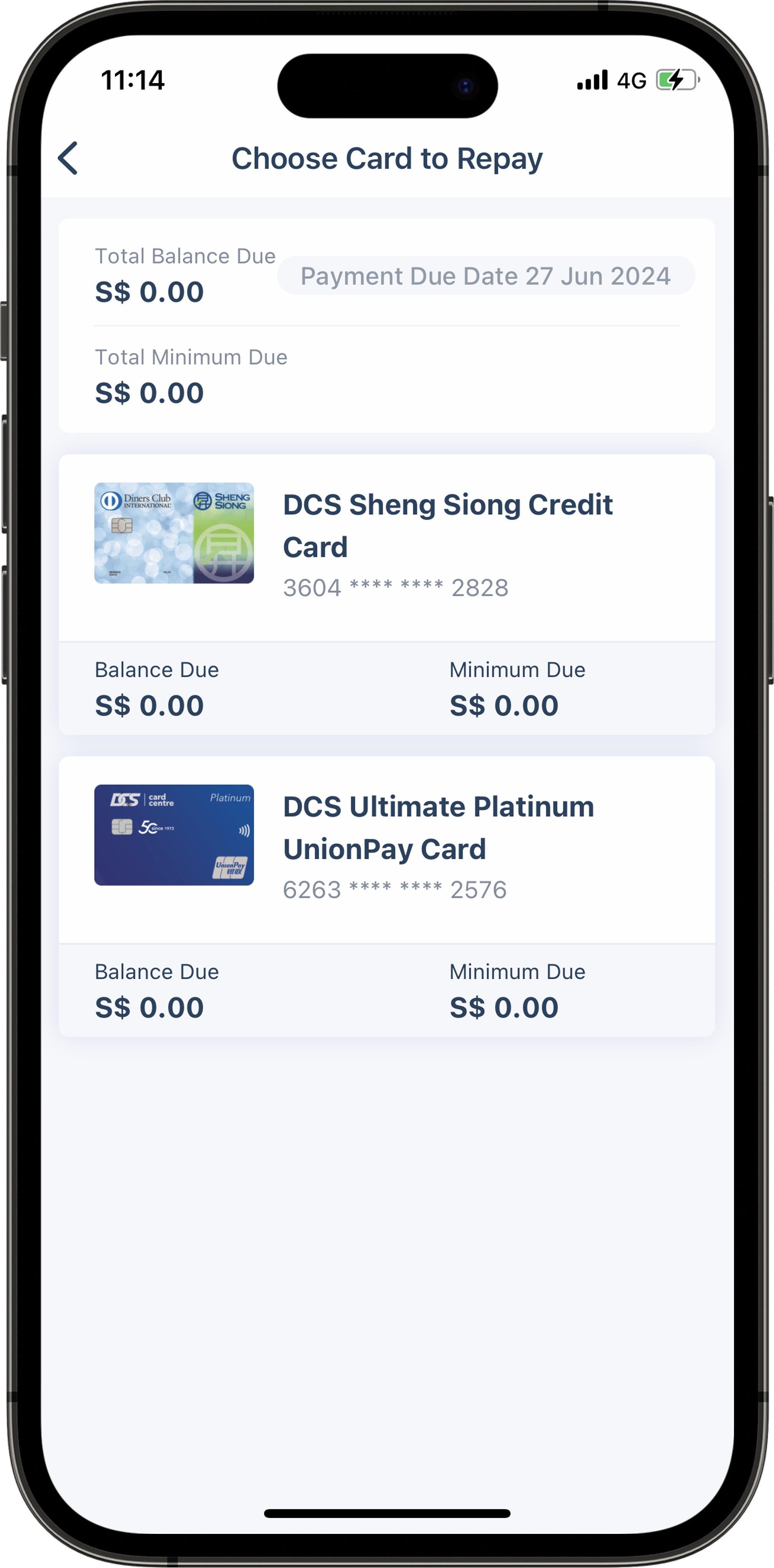

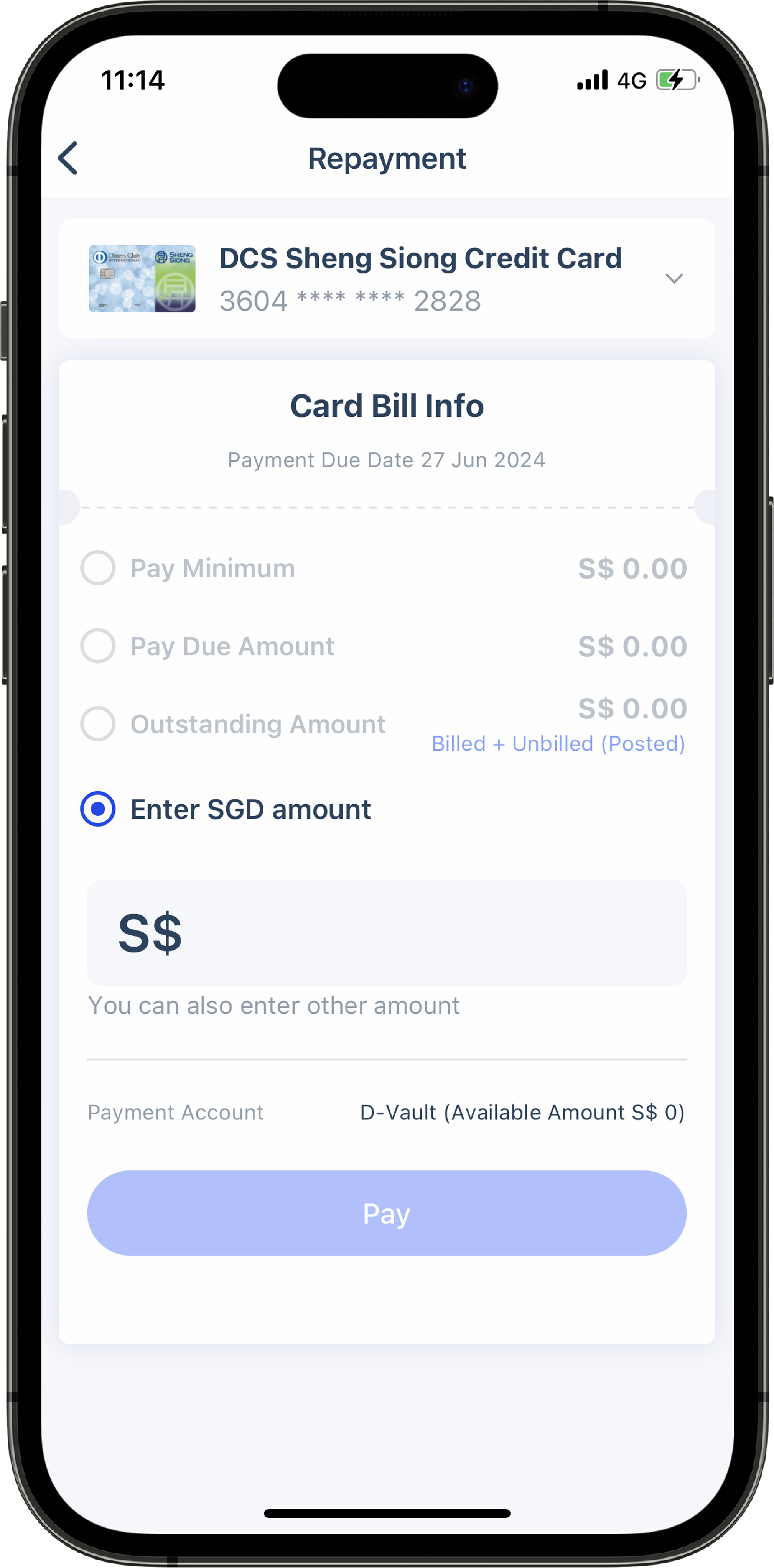

Card Repayment with D-Vault balance

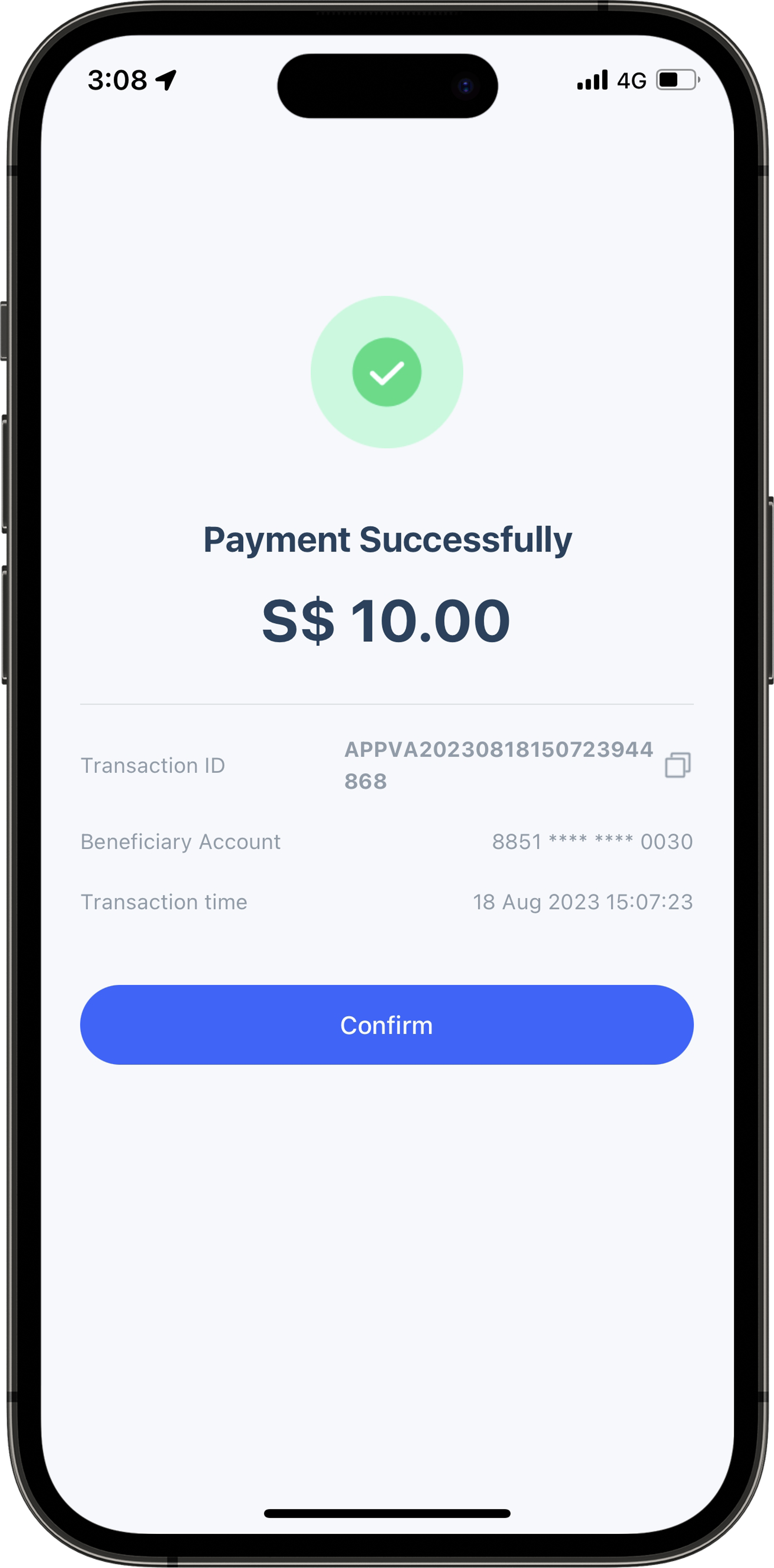

- Login to the DCS Cards app and navigate to D-Vault.

- Tap on the ‘Repayment’ tab to initiate the card repayment.

- Select the DCS Card(s) to repay and progress accordingly.